Shadhin

Opis Shadhin

*Please note that at this stage Shadhin services are invite only.

Currently our services are only available for:

Repeat borrowers with credit scores above 400

Farmers under bhalo

Other invite only Shadhin customers

We are sorry to not be able to serve you if you don’t fall under the above-mentioned categories.

We are currently working on making our services available to everyone.

—

Shadhin is a financial technology company with the primary objective of digitising the financial sector of Bangladesh and driving financial inclusion among Bangladeshis. Currently, Shadhin has developed a mobile phone application called the “Shadhin App” which is a digital platform that will bring individuals under one marketplace to enable individuals to get funding from regulated financial entities.

Using our platform, borrowers can easily apply for loans in our partner, government-accredited financial institutions of Bangladesh. We have an entirely paperless process, allowing people to avail funding opportunities in less than 10 minutes. With our technology and vigorous verification process, we are able to connect high-quality borrowers with regulated banks and MRA entities.

*Please note that Shadhin does NOT provide any loans but only connects borrowers with financial institutions*

Our Products

Digital Nano Loans from Banks (In Progress)

Loans from Microcredit Organisations

Loans for Farmers via Microcredit Organisation (In Progress)

Women Only Loans via Microcredit Organisation (In Progress)

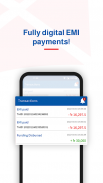

Digital Nano Loans from Banks

Loan Amount: BDT 5,000 to BDT 30,000

Repayment Tenure:

Minimum: 3 months (minimum 90 days)

Maximum: 12 months

Annual Percentage Rate (APR): 9% (as regulated by Bangladesh Bank)

Origination Fees: 0.5%

Other Processing Fees: 0%

Example

If a user applies for a loan of BDT 20,000 for 6 months:

Origination Fee: BDT 100

Receivable Amount: 19,900 (20,000 - 100)

Monthly Payment (EMI) = BDT 3,421.38

Total Payment (Principal + Interest) = BDT 20,528.28

Total Interest Payable = BDT 528.28

Loans from Micro Finance Institutions

Loan Amount: BDT 5,000 to BDT 90,000

Repayment Tenure:

Minimum: 3 months (minimum 90 days)

Maximum: 12 months

Annual Percentage Rate (APR): 24% (this is the maximum possible interest rate)

Origination Fees: 0%

Other Processing Fees: 0%

Example

If a user applies for a loan of BDT 10,000 for 12 months (taking interest rate as 24%):

Monthly Payment (EMI) = BDT 945.60

Total Payment (Principal + Interest) = BDT 11,347.20

Total Interest Payable = BDT 1347.20

Verification and Due Diligence

Shadhin maintains 100% transparency in handling data and has a strict privacy policy in place. You can learn more about it here [https://shadhinbd.com/privacy_policy/]. Shadhin assures you that none of your data will be used without your consent.

Shadhin conducts e-KYC by reviewing and verifying information related to the loan applicant’s identification, name and address. Moreover, Shadhin verifies the submitted documents using AI and other government-approved sources